Accounting is a fundamental aspect in the management of any company, regardless of the sector. Managing the accounts and financial operations of a company can be tedious and can greatly affect the working hours of both the directors and employees of a company. A complete management solution that allows accounting operations to be executed with ease will save time and resources, and this is where Odoo becomes one of the best business and resource planning software (ERP), providing numerous advantages over other available programs.

The new version of Odoo released in 2020, has numerous Odoo apps, among which is a complete business accounting module, which thanks to its easy usability and customization, is considered one of the best and most advanced management programs, allowing direct connection with the SII (VAT Information Supplies), analytical accounting and using the Spanish accounting plan, among many other things.

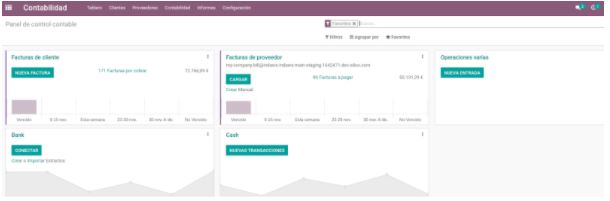

Odoo Accounting Dashboard

The Odoo 14 accounting dashboard is equipped with all the necessary options to manage the financial aspects of the company. In the menu you will find the customers, suppliers and advanced analytical reporting features, you will get complex, organized and easy-to-use information. The user can perform tax invoice operations, generate invoices, automatically connect with the bank, create and consult supplier invoices...etc.

Odoo 14's accounting dashboard is equipped with all the necessary options to manage the financial aspects of the company.

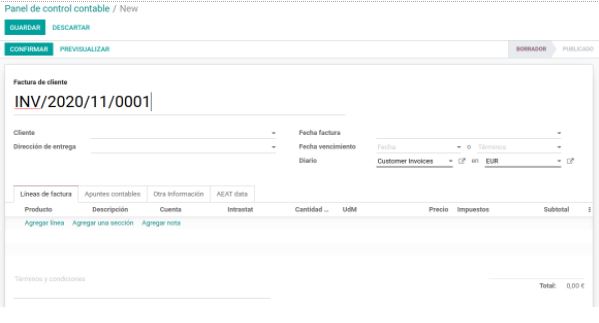

Invoice generation

From the invoice window included in the “customers” section, the user can create, modify or cancel invoices to customers.

All generated invoices can be viewed from the “invoices” window and various actions can be performed on them, selecting customers, choosing the delivery address, due date, products...

In this section, the user can also perform various operations related to their clients:

- Follow-up report: Follow-up of invoice payments, modifications, payment cancellations...

- Products: here we will find all the listed products, being able to add new products from this same tab or modify some of the characteristics.

- Clients: here we will find the list of all clients, being able to create new client files or access the ones created, to modify data if necessary.

Suppliers

The Accounting Panel's Suppliers menu provides functional operations such as payments, refunds, creating suppliers, and many more. All operations regarding suppliers can be activated from here.

- Invoices: Supplier invoices can be generated from this menu, with the option of being generated based on delivered products or orders. Prices can be entered manually when agreed with the supplier or come from rates previously entered with the supplier.

- Returns: In the case of a commercial operation that requires an exchange and/or return of products to the supplier, we use the returns function. This function allows users to request a refund of amounts, based on the items listed in the window.

- Payments: Here you can see all the company's payment operations towards the supplier's invoices, a function connected to the accounting module, to integrate an operation in real time.

- Suppliers: The user can perform various operations on the suppliers' contact data, as well as create new contacts. It is important to provide your suppliers in Odoo with as much information as possible, as this will facilitate your company's processes. For example, "Tax Items" facilitates the filing of taxes or the introduction of rates by supplier, which improves the productivity of the purchasing department.

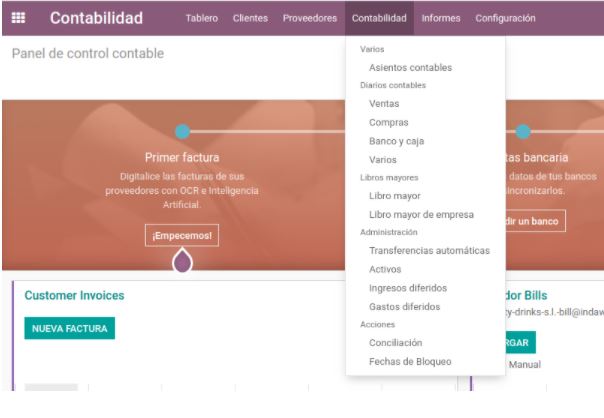

Accounting Menu

In the accounting menu of the module, the user can perform all operations related to the accounting of his company.

Journal entries can be reviewed and verified. There is a list of the different types of ledgers available on the platform and the operations listed in each one, and various management operations, such as asset management, transfers or revenue management, can be performed from the respective windows.

From this window the user can also create and work on various application actions, such as bank reconciliation and lockout dates, to ensure that no accounting data is entered after a period has been closed.

The “Reports” tab allows users to generate various financial reports such as profit and loss, balance sheet, tax reports…

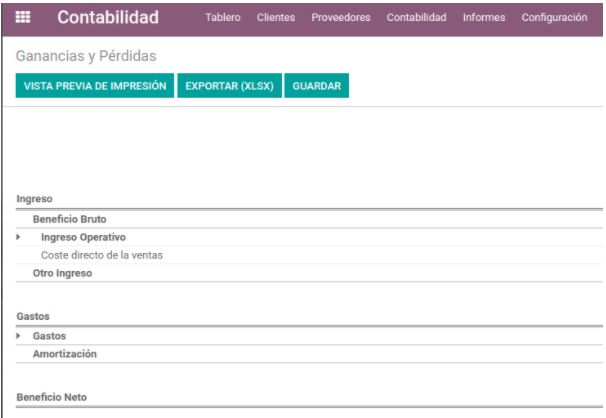

Reports

The reporting functionalities in the accounting module of the Odoo platform provide descriptive and analytical reporting options. The window allows users to generate various financial reports such as profit and loss, balance sheet and many more. The new update in Odoo allows users to generate tax reports such as Form 111, 115, 303, 347, 349 as well as Intrastat. It is important to have a partner like Indaws to ensure that such reports are executed properly.

Generic Statements

Odoo provides the user with the ability to generate various generic reports such as:

- Profit and Loss Statement: All profits and losses from the company's business operations are listed, along with various filtering and grouping options available.

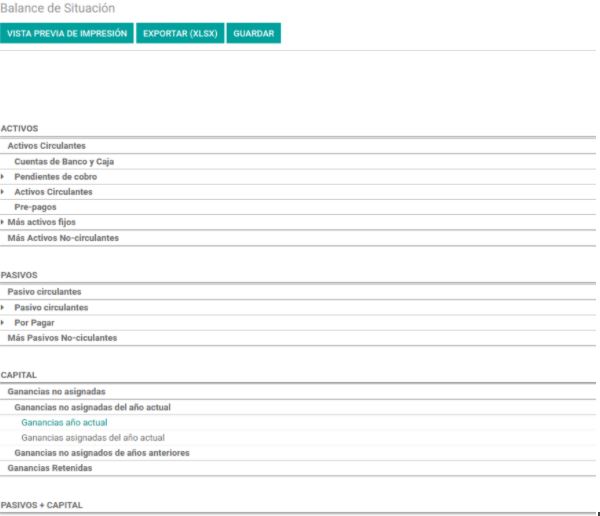

- Balance Sheet: This shows all the company's financial operations grouped into Assets, Liabilities and Capital (Net).

- Executive Summary: The summary report, on the various financial aspects of the executive operations, is displayed here.

- Cash Flow Statement: All the cash flow details of the company's operations, from all aspects of the operation, are displayed.

- Partner Reports: The Odoo Reports module, allows users to generate various reports, based on the partner operations of the company, such as Partner Ledger, Receivable Ageing, and Payable Ageing.

- Audit Reports: Reports from the audit function of the company can be derived from this window. These would be beneficial in understanding the operations of the company and the financial status of the company. The various audit reports such as General Ledger, Trial Balance, Consolidated Journals, Tax Reports, and Journal Audit Reports can be generated from this window.

These advanced features and tools of the Odoo 14 accounting module will lead the user to rely on it for all financial aspects of the company, becoming an extremely useful tool for managing assets and liabilities operations for which the company is responsible.

Conclusión

Odoo se presenta como una solución integral e innovadora para la gestión contable de empresas. Este software permite a las organizaciones optimizar sus operaciones financieras de manera eficiente y efectiva. • Integra funcionalidades clave para la contabilidad empresarial, mejorando así el flujo de trabajo. • Permite la personalización y adaptación a diferentes planes contables, maximizando su utilidad. • Ofrece un tablero contable intuitivo que facilita la gestión y comprensión de los datos financieros. • Simplifica el proceso de generación de facturas, seguimiento de pagos y gestión de proveedores, liberando tiempo valioso. • Proporciona herramientas analíticas robustas para la creación de informes, facilitando la toma de decisiones a partir de datos precisos.

¿Qué características destacan en el módulo de contabilidad de Odoo?

El módulo de contabilidad de Odoo ofrece características como la generación de facturas, seguimiento de pagos, gestión de proveedores y la capacidad de conectarse directamente con la información fiscal. Su dashboard intuitivo facilita una visión clara de la situación financiera de la empresa, permitiendo accesos rápidos a las operaciones clave y a análisis detallados mediante reportes simplificados.

¿Cómo ayuda Odoo a optimizar la gestión contable?

Odoo optimiza la gestión contable al automatizar procesos como la generación de informes fiscales y contables, facilitando el seguimiento de ingresos y gastos. Su integración con otras aplicaciones dentro del ERP permite una visión holística de la empresa, ahorrando tiempo y recursos al reducir la necesidad de múltiples sistemas. Esto se traduce en una mayor eficiencia y en una toma de decisiones más informada.

¿Qué tipos de informes se pueden generar con Odoo?

Odoo permite generar una variedad de informes financieros esenciales, como el estado de resultados, balance general, flujos de efectivo y reportes fiscales específicos, como el Formulario 303. Estos informes se adaptan a las necesidades de la empresa y proporcionan una visión clara del rendimiento financiero, facilitando el análisis y la presentación de datos a las partes interesadas.